A fresh perspective on the Challenger Sale research

August 21, 2019

First published in 2011, “The Challenger Sale” must be one of the most widely-read sales books of the past decade, and with good reason. Together with its successor “The Challenger Customer” (which I believe is an even more influential book), it served to introduce powerful new perspectives about today’s increasingly complex B2B sales environment.

First published in 2011, “The Challenger Sale” must be one of the most widely-read sales books of the past decade, and with good reason. Together with its successor “The Challenger Customer” (which I believe is an even more influential book), it served to introduce powerful new perspectives about today’s increasingly complex B2B sales environment.

The books included a lot of thought-provoking original research - including the widely misinterpreted idea that, on average, the typical B2B buying process is 57% complete before the average customer is ready to talk to a salesperson. The reality, of course, is that the actual figure varies significantly depending on (amongst other things) whether the customer is involved in a familiar or unfamiliar purchase.

But that wasn’t the only data point or - in my opinion - the most important insight, and in a recent webinar the Challenger® team shared some of their latest research into B2B buying motivations. I think you’ll find the conclusions fascinating...

The drivers of customer loyalty

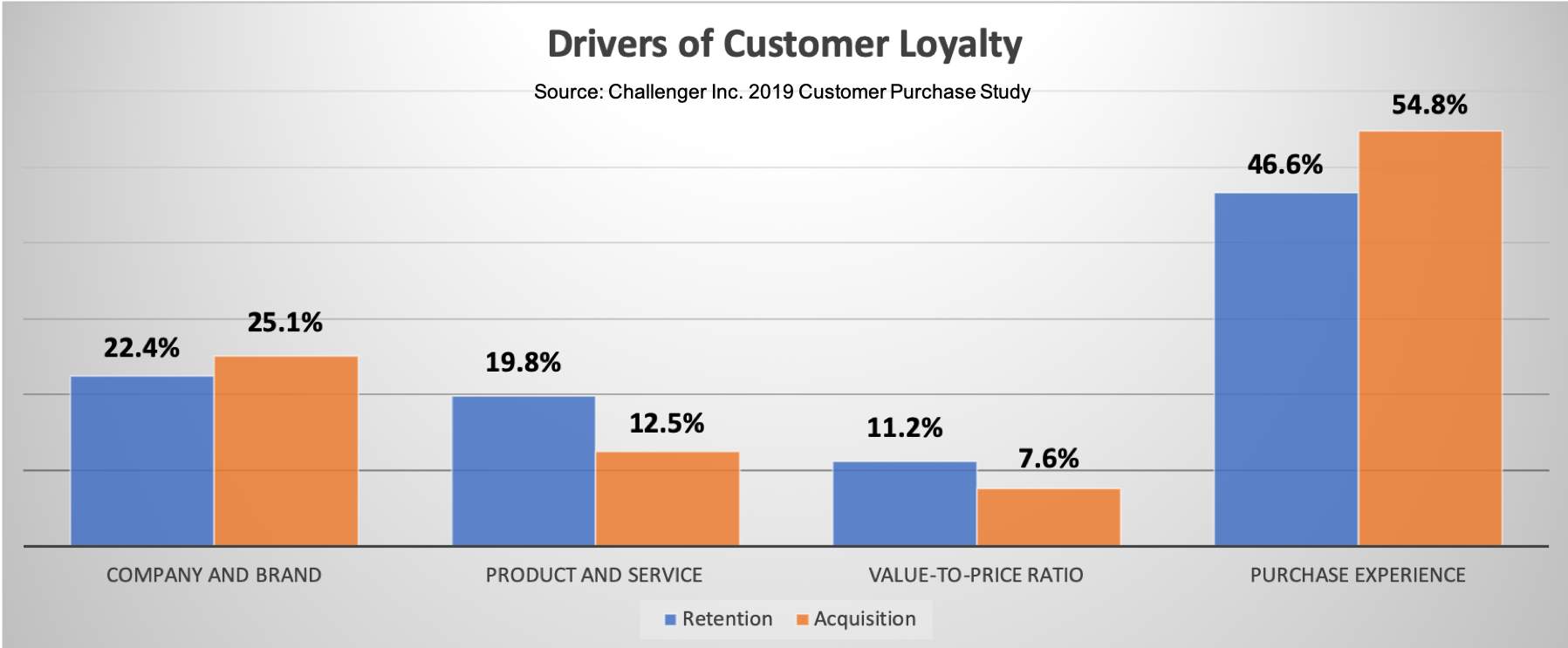

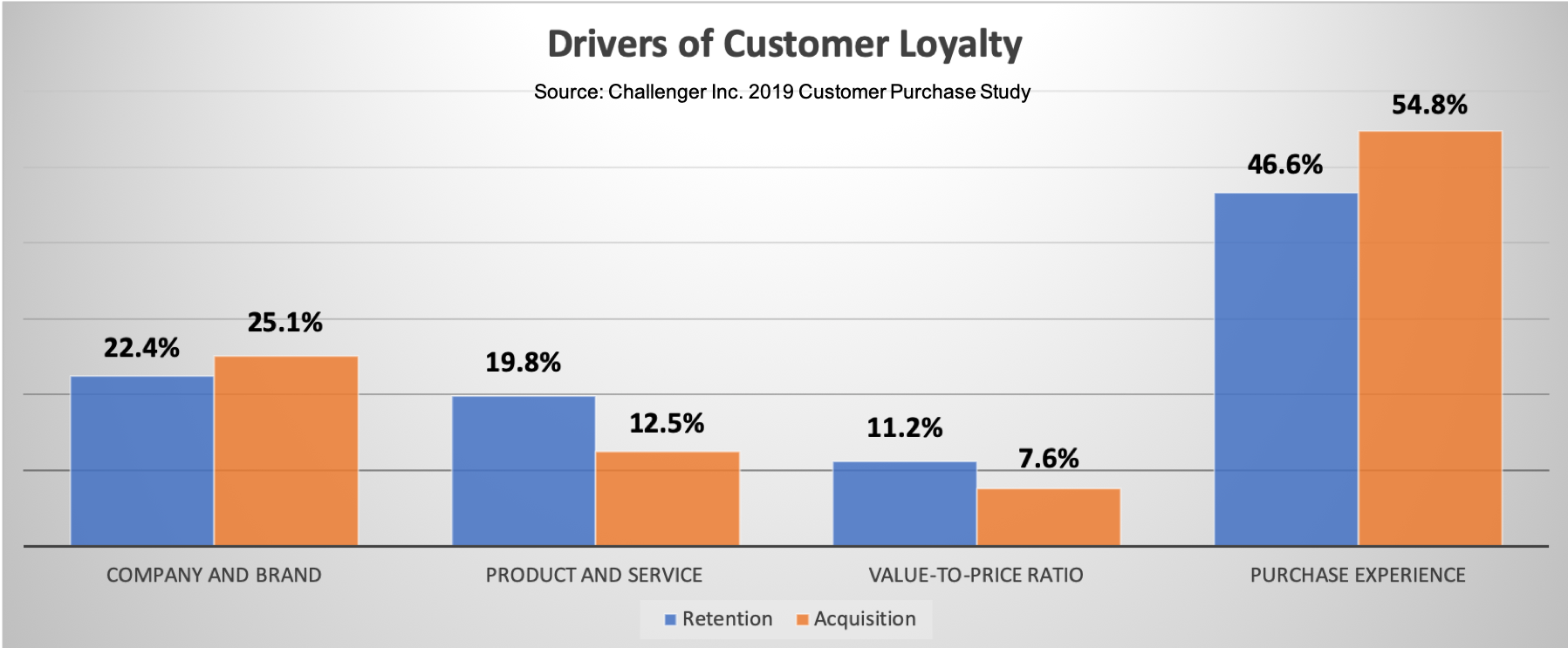

Less widely-quoted but in my experience more far more valuable was their research into the drivers of customer loyalty. You may recall that the original research concluded that the purchase experience - at 53% - was by far the most important influence:

- Purchase experience 53%

- Product and service delivery 19%

- Company and brand 19%

- Value-to-price ratio 9%

Those conclusions made pretty sobering reading for technology-based businesses who based their messaging (and their sales conversations) largely on product specifications and/or price. The research highlighted the importance of the actual purchase experience - which includes the skill of the salesperson, the clarity of the commercial message, the ease of the buying process and service and implementation support.

How have things changed?

But that was then (2011) and this is now. How have things changed? When you simply ask the same questions and reapply the same analysis, the differences are marginal, but understandable. In 2019 the equivalent factors are:

- Purchase experience 50.4% [↘]

- Product and service delivery 16.1% [↘]

- Company and brand 21.1% [↗]

- Value-to-price ratio 12.4% [↗]

So - the purchase experience still predominates, if slightly less overwhelmingly. Company and brand have become more important than product and service delivery, and value-to-price ratio remains in last place but has become slightly more important. The shift from product to brand probably reflects the increasing importance of vendor reputation and confidence in outcomes. But the changes are hardly earth-shattering.

Customer acquisition vs. customer retention

But what about the differences between customer acquisition and customer retention? It’s a question that wasn’t asked in the initial research, but the new findings indicated patterns that are consistent with, for example, the excellent research done by Corporate Visions in this area.

As you can see from the chart below, there are some interesting differences when it comes to new customer acquisition versus existing customer retention. The purchase experience and company and brand impact are relatively more important in winning new customers, whereas product and service delivery and value-to-price are relatively more important to the “user experience”.

We can draw a number of conclusions from this. First, that the purchase experience remains by a considerable distance the most important factor in both scenarios. Second - and unsurprisingly - the “user experience” becomes significantly more important when it comes to customer retention.

This is, of course, why “customer success” has become such an important function in a growing number of organisations. But the customer success function shouldn’t just be about satisfying the customer’s immediate needs: it also needs to help the customer recognise the full business value in use of the solution they have acquired.

The critical sales skills

How should we react to these findings? Well, of course, sales leaders need to do all that they can to facilitate an excellent purchase and ongoing user experience. But what do buyers regard as the most valuable sales skills? The new research shone a light on these priorities, as well. Buyers rank the following skills as the most important contributors to the overall purchase experience:

- The salesperson demonstrates unique insight

- The salesperson helps me come to a decision

- The salesperson works to understand and address stakeholder interests

- The salesperson helps me build support across my organisation

- The salesperson makes it easy for me to make a purchase

You’ve probably noticed something: product knowledge doesn’t appear on the list (in fact it doesn’t even appear in the top ten). Nor does the salesperson’s ability to deliver your company presentation. Or to demonstrate the product.

The research reinforces the importance of business acumen and empathy. It highlights the essential need to teach our customer something valuable, to tailor the conversation to the customer’s specific circumstances, and to take control of the direction of dialogue.

Top performing salespeople tend to have these natural attributes. But even middle-of-the-road salespeople are capable of developing these skills. Are you sure that your training programmes and sales methodologies making the most of their potential? If not, we should talk...

ABOUT THE AUTHOR

Bob Apollo is a Fellow of the Association of Professional Sales, a member of the Sales Enablement Society, a founding contributor to the International Journal of Sales Transformation and the Sales Experts Channel and the founder of Inflexion-Point Strategy Partners, the leading UK-based B2B value-selling experts.

Bob Apollo is a Fellow of the Association of Professional Sales, a member of the Sales Enablement Society, a founding contributor to the International Journal of Sales Transformation and the Sales Experts Channel and the founder of Inflexion-Point Strategy Partners, the leading UK-based B2B value-selling experts.

Following a successful corporate career spanning start-ups, scale-ups and market leaders, Bob is now relishing his role as a pro-active advisor, coach and trainer to high-potential B2B-focused sales organisations, systematically enabling them to transform their sales effectiveness by adopting the proven principles of value-based selling.

Comments